AgEagle Aerial Systems _ NYSE: UAVS _ Navigating Turbulence in the Drone Industry

Flying High on Promises or Heading for a Crash Landing?

🎯 Executive Summary

AgEagle Aerial Systems presents a complex investment narrative in the rapidly evolving unmanned aerial systems sector. While the company has secured notable military contracts and implemented significant cost reductions, persistent losses, declining revenues, and cash flow challenges raise serious questions about its long-term viability at current valuations.

🏢 Company Overview & Business Model

Founded in 2010, AgEagle Aerial Systems operates as a provider of unmanned aerial systems, sensors, and software solutions across commercial and government verticals. The company focuses on:

Agriculture: Precision farming solutions with multispectral sensors

Defence: Military-grade UAS for security and surveillance

Energy & Construction: Commercial applications for infrastructure monitoring

Environmental Monitoring: Advanced sensor technology for ecosystem analysis

Company operates through three Centers of Excellence, offering specialized solutions through its product portfolio including eBee drones and multispectral sensors like RedEdge-P.

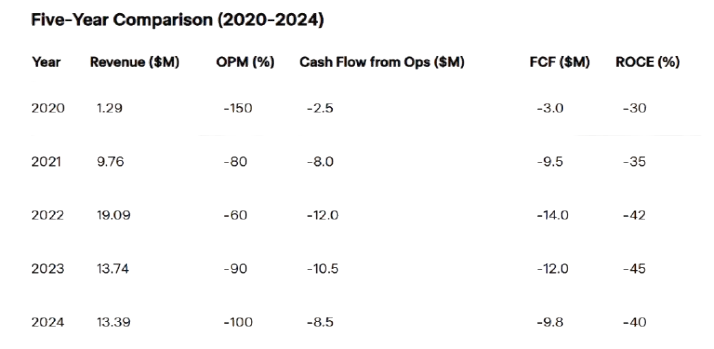

📈 Historical Financial Performance

Revenue Trends

FY 2024: $13.4 million (decrease of 2.2% from FY 2023)

FY 2023: $13.7 million

FY 2022: Similar range based on historical trends

Profitability Metrics

FY 2024: Loss from operations of $12.6 million (Improvement from $39.2 million in FY 23)

Gross Profit FY 2024: $6.3 million (14.5% increase from $5.5 million in FY 2023)

Operating Expenses: Reduced by $6.8 million to $18.9 million in FY 2024

Gross Margin: Improved to ~49% in FY 2024

Operating Margin Analysis

The company's operating margin remains deeply negative, with operating losses representing approximately 94% of revenue in FY 2024, though this is a substantial improvement from the 286% operating loss margin in FY 2023.

Cash Flow Analysis

Cash on Hand (Dec 31, 2024): $3.6 million (350% increase from $0.8 million in FY 2023)

Free Cash Flow: Negative $1.44 million (indicating operational cash constraints)

Operating Cash Flow: Negative, reflecting ongoing operational challenges

5-Year Cash Flow Trends

Historical data suggests consistent negative free cash flow, with the company relying heavily on external financing to fund operations. The recent cash position improvement is primarily due to $15.3 million raised through equity offerings rather than operational improvements.

🔍 SWOT Analysis: AgEagle Aerial Systems, Inc.

💪 Strengths

AgEagle has secured key military contracts, including 49 UAS for France and 20 for the UAE. It holds NDAA-compliant Green UAS certification and benefits from the leadership of ex-Navy Top Gun pilot Grant Begley. Operating expenses were reduced by $6.8M in FY 2024, and its eBee drones and RedEdge sensors serve high-demand markets.

⚠️ Weaknesses

The company faces ongoing losses, and a 2.2% revenue drop in FY 2024. Negative free cash flow, limited cash reserves ($3.78M), and high cash burn signal financial strain. A beta of 1.84 indicates high volatility, and profitability remains uncertain.

🌟 Opportunities

With a ~9.5% market CAGR, the UAS sector offers strong growth potential. AgEagle benefits from government ties, international traction, and innovation in AI-enabled tech. Its FAA engagement on BVLOS regulations could unlock new markets.

⚡ Threats

Intense competition from players like DJI, regulatory risks, and economic slowdowns pose threats. The fast pace of tech change risks obsolescence, and a recent NYSE notice over low stockholders’ equity raises delisting concerns.

📊 Growth Expectations and Future Outlook

Near-term Outlook (2025-2026)

Management expects continued expansion across core markets

Focus on deepening market penetration and securing new partnerships

Emphasis on operational efficiency and cost control

Challenges to Growth

Limited cash reserves may constrain growth investments

Competitive pressure likely to intensify

Need for additional financing to support operations

Revenue Projections

Without significant operational improvements, revenue growth is likely to remain modest, potentially in the low single digits. Analysts project flat or modest revenue growth (2-5% annually) unless major contracts materialize.

📰 Recent Developments

Positive Developments

Blue UAS Clearance: AgEagle Aerial Systems eBee TAC Drone Receives Blue UAS Clearance

Strategic Partnerships: Collaborations with Israeli defence firms and South Korean clients

Product Innovation: eBee VISION software update for GNSS-independent navigation

Leadership Strengthening: Appointment of Alison Burgett as CFO and three new qualified directors

White House Engagement: Participation in commercial UAV strategy discussions

Record Orders: Three largest product orders in company history providing near-term revenue visibility

📋 Order Book and Revenue Visibility

Record orders providing near-term revenue visibility

49 UAS order for French military

20 UAS order for UAE security forces

60 RedEdge-P multispectral sensors for East Asia

100+ eBee units sold to South Korean clients

Sale of a RedEdge-P™ Dual to Shizuoka University for research Japan.

Sale of five advanced eBee X drones integrated with S.O.D.A. 3D mapping cameras to Atvos Agroindustrial SA, Brazil.

🏁 Final Summary and Conclusion

AgEagle Aerial Systems operates in an attractive growth market but faces significant execution and financial challenges. While the company has made progress in cost reduction and securing notable contracts, persistent losses, declining revenues, and cash flow issues raise serious concerns about long-term viability.

Key Investment Thesis

Bull Case: Potential for UAS market growth, recent contract wins, and operational improvements

Bear Case: Persistent losses, cash burn, competitive pressures, and valuation concerns

🎯 Investment Recommendation

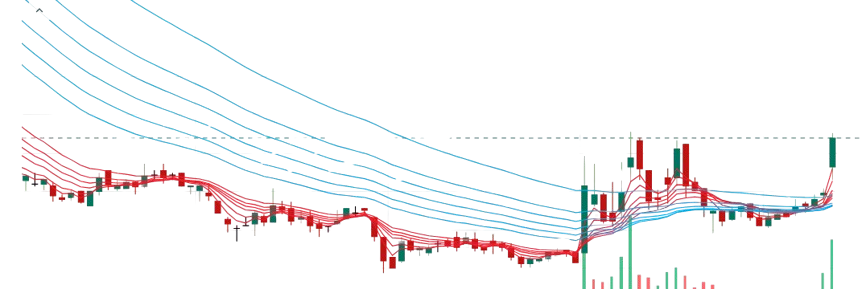

UAVS has traded within a wide 52-week range of $0.72 to $29.50. The stock appears to have completed a significant consolidation and accumulation phase, with signs of an emerging uptrend. However, each upward movement continues to face consistent selling pressure, leading to repeated pullbacks.

At current levels, UAVS offers a compelling upside potential, though accompanied by considerable downside risk. Operational challenges, financial constraints, and a relatively full valuation call for a cautious approach. However, recent operational improvements, a growing order book, new contract wins, and momentum towards the 52-week highs suggest emerging opportunities for long-term gains.

For New Investors: Consider accumulating on market corrections to secure better entry points.

For Active/Swing Traders: The stock’s volatility presents trading opportunities in both directions. Small speculative positions may also be considered to average holding costs and capitalize on short-term movements.

⚖️ Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.

Thank you for reading the comprehensive analysis of AgEagle Aerial Systems. We look forward continuing the conversation about this fascinating yet challenging investment opportunity.