ChargePoint Holdings: When Charging Infrastructure Meets Financial Turbulence

The EV Pioneer Struggling to Keep Its Battery Alive

Company Overview

ChargePoint Holdings, Inc. (NYSE: CHPT) is one of North America’s largest EV charging network providers, offering hardware and cloud-based solutions that enable users to locate, reserve, and manage charging sessions.

Recent Developments

Reverse Stock Split: In July 2025, the company executed a 1-for-20 reverse stock split to maintain NYSE listing compliance after its share price fell below $1—a red flag indicating distress.

Cost Reduction & Restructuring: Implemented $41 million in annualized savings, 15% workforce reduction, and 30% GAAP / 28% non-GAAP expense cuts in FY2025.

Leadership & Product Launches: Appointed David Vice as Chief Revenue Officer and launched the CPF50 Level 2 charger and ChargePoint Essential cloud plan for small businesses.

Financial Outlook

Q4 FY2025 Guidance: Revenue projected at $95–105 million, indicating persistent pressure.

FY2026 Goal: Targeting positive non-GAAP Adjusted EBITDA in at least one quarter.

Market Potential: Global EV charging market projected to grow at 15% CAGR to $76 billion by 2032, though ChargePoint’s ability to capture market share remains uncertain.

Analyst Targets: Average 12-month target at $13.56 (per MarketBeat, October 2025), with estimates ranging from $12.18–$16.60 (and an outlier of $32.53 (GuruFocus GF Value).

Investment View

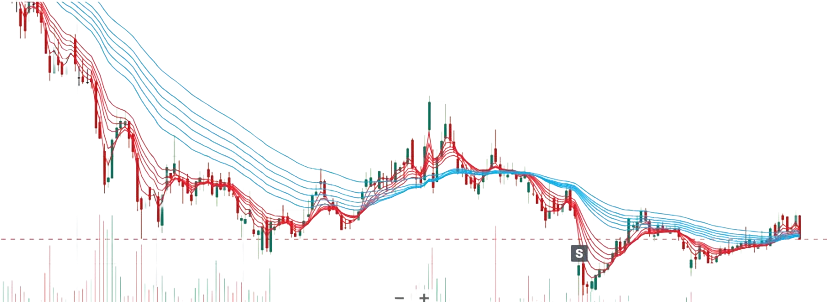

Despite operating in a high-growth sector, ChargePoint is grappling with declining revenues, liquidity pressures, and rising competitive challenges. While recent cost-cutting measures seem more defensive than strategic, technical indicators suggest a potential turnaround. The daily chart indicates that the prolonged downtrend and subsequent consolidation phase appear to have ended, with the stock now positioned at a crucial crossover point—signaling the early signs of an emerging uptrend.

Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.

Let’s Talk!

What are your thoughts on ChargePoint’s turnaround prospects?

Share your perspectives, analysis, and investment thesis in the comments below.