Lululemon Athletica Inc. (NASDAQ: LULU) _ The Giant’s Mid-Life Crisis

How Product Stagnation, Tariff Pressures, and U.S. Market Weakness Triggered a Price Shock in September 2025

Lululemon Athletica, the iconic Canadian athleisure brand, faces one of the most turbulent phases in its history. Once a trendsetter in premium activewear, the company is now battling competitive pressures, slowing U.S. demand, and internal product fatigue.

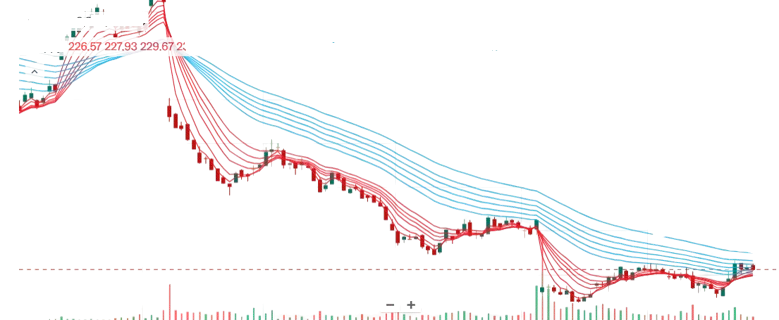

As of October 2025, Lululemon’s stock trades near $178, down 65% from its December 2023 high of $511, marking a severe value erosion within 18 months.

The September 2025 Price Jolt — Root Causes

The sharp 15–20% plunge in September 2025 followed disappointing Q2 FY2025 results, revealing structural weaknesses long in the making:

Soft U.S. Demand: Americas revenue up just 1%, with comparable sales down 4%—a stark contrast to 22% growth internationally and 25% in China.

Tariff Hit: Removal of the de minimis exemption and higher import duties led to an estimated $240 million profit impact, cutting operating margin by 210 bps.

Guidance Cut: FY2025 revenue outlook trimmed to $10.85–$11 billion and EPS to $12.77–$12.97, well below prior forecasts.

Intense Competition: Rapidly expanding rivals like Alo Yoga and Vuori gained share, while Nike and Adidas defended their turf aggressively.

Together, these issues exposed a maturing brand struggling to refresh itself amid market saturation and changing consumer tastes.

Financial and Valuation Snapshot (Oct 2025)

Lululemon reported Q2 revenue of $2.53 billion, reflecting a 7% year-over-year increase, while EPS stood at $3.10, beating estimates, gross margin slipped by 110 basis points to 58.5%, indicating some pressure on profitability. Key return metrics remained robust, with ROE at 42% and ROIC at 27%, highlighting strong capital efficiency. The balance sheet continues to be solid, supported by $1.2 billion in cash and a debt-to-equity ratio of just 0.40.

Further, Lululemon’s trailing P/E of around 12×, far below its 10-year average of 42×, underscores a sharp valuation compression driven by market skepticism over its ability to reignite growth momentum.

Management Response and Outlook

The company has outlined a Product Refresh Initiative aimed at revitalizing its innovation engine:

Increase new styles to 35% of total assortment by Spring 2026

Accelerate “fast-track” design cycles for quicker trend response

Continue aggressive international expansion, particularly in China and Europe

While these steps show promise, execution remains key.

Conclusion & Recommendation

Lululemon’s sharp decline in September 2025 was a fundamentally driven correction rather than a mere market overreaction. A mix of tariff shocks, aging product cycles, weakening U.S. store traffic, and intensifying competition exposed signs of mid-cycle brand fatigue.

However, the company’s solid fundamentals—42% ROE, strong cash generation, and accelerating international growth— provide a strong foundation for recovery. If management can revitalize product innovation and reignite U.S. demand, Lululemon could regain its premium positioning and valuation multiple.

Recommendation: Maintain a “Hold” stance in the NEAR TERM, with a bias toward accumulation on further dips for LONG-TERM investors, as a successful turnaround could unlock meaningful upside over the next 12–18 months.

Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.