NORTHERN SHIELD: Canada's Defence Renaissance Creates Investment Goldmine

The Great White North's $80 billion defence transformation is creating unprecedented opportunities for savvy investors

The Strategic Shift: From Peacekeeping to Defence Dominance

Canada is experiencing its most dramatic defence transformation since World War II. With geopolitical tensions escalating globally and Arctic sovereignty becoming critical, Ottawa has committed to a massive $80 billion defence modernization package that's reshaping the entire Canadian military-industrial complex.

The numbers tell the story: Canada's defence budget has surged from $26.9 billion in 2024 to over $36 billion projected for 2025-26—a leap that puts the nation on track to meet NATO's 2% GDP target five years ahead of schedule. This isn't just increased spending; it's a strategic pivot toward domestic defence self-sufficiency that's creating a new generation of Canadian defence champions.

The Investment Opportunity: Seven Defence Stocks to Watch

Tier 1: The Established Titans

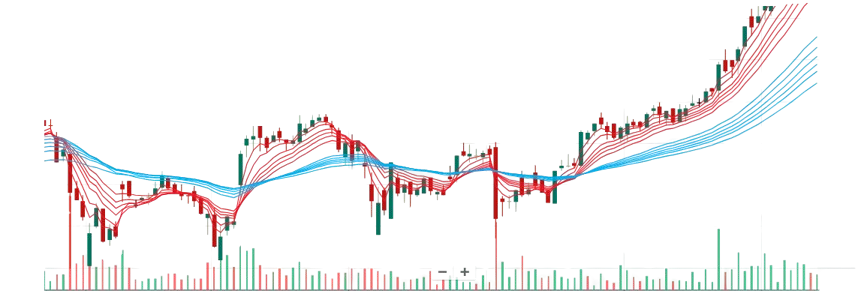

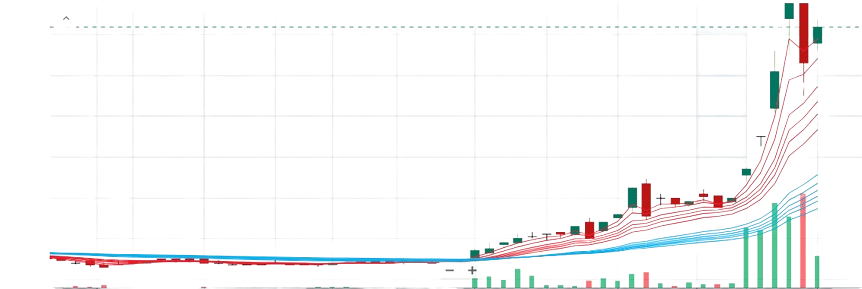

CAE Inc. (TSX/NYSE: CAE) - The Training Empire

Current Price: $29 USD ($39.80 CAD)

Market Cap: $9.3-9.4 billion USD

FY 2025 Revenue: $4.71 billion CAD (+9.9% YoY)

Net Income: ~$405 million CAD (8.6% margin)

Growth Outlook: 11.6% annual EPS growth expected

Why CAE Dominates: As the world's leading military flight simulator company, CAE is the direct beneficiary of Canada's $11.2 billion SkyAlyne pilot training program. With an $11.7 billion defence backlog and expanding AI-powered simulation capabilities, CAE is positioned to capture the lion's share of Canada's training modernization.

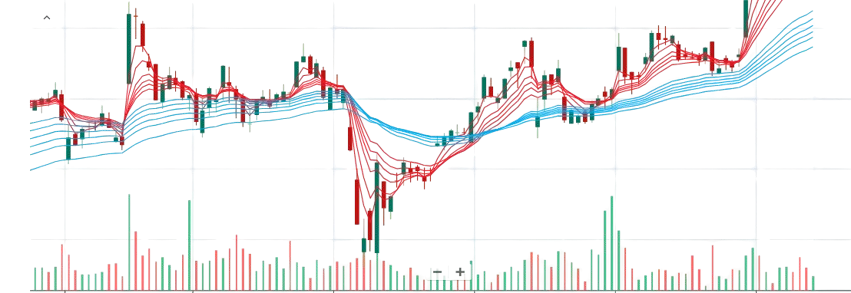

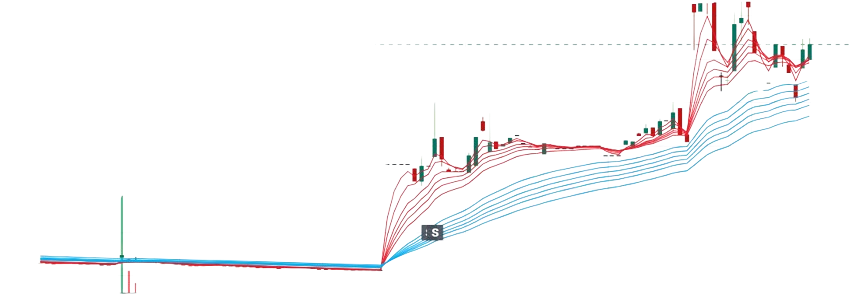

Héroux-Devtek Inc. (TSX: HRX) - The Aerospace Specialist

Current Price: $32.48 CAD

Market Cap: $1.09 billion CAD

FY 2024 Revenue: $629.8 million CAD (+16% YoY)

Net Income: $38.3 million CAD (+177% YoY)

The HRX Advantage: As the world's third-largest landing gear supplier, Héroux-Devtek is experiencing explosive growth. Q1 2025 results showed 24% revenue growth and 216% net income surge, driven by both defence and commercial aviation recovery.

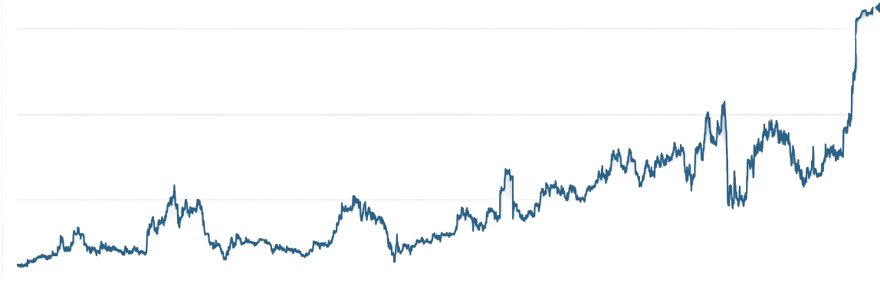

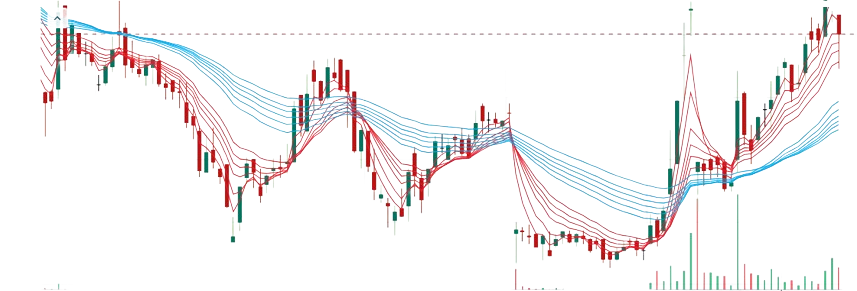

MDA Ltd. (TSX: MDA) - The Space Surveillance Leader

Q1 2025 Revenue: $351 million CAD (+68% YoY)

Net Income: $37.2 million CAD (+103% YoY)

MDA's Strategic Moat: With RADARSAT satellites and space-based surveillance systems, MDA is indispensable for Canada's Arctic sovereignty strategy. The company's explosive 68% revenue growth reflects the global demand for space-based defence capabilities.

Tier 2: The Emerging Champions

BlackBerry Ltd. (TSX/NYSE: BB) - The Cyber Guardian BlackBerry's transformation into a cybersecurity powerhouse aligns perfectly with Canada's need for military-grade secure communications. Through QNX and Cylance platforms, BlackBerry is becoming the backbone of Canada's digital defence infrastructure.

Drone Delivery Canada (TSXV: FLT), now known as Volatus Aerospace Inc.- The UAV Pioneer

Current Price: ~$0.80-0.84 CAD

Market Cap: $58-67 million CAD

Growth Catalyst: Recent merger with Volatus Aerospace

Defence Role: DND contracts for Beyond Visual Line of Sight (BVLOS) technology

KWESST Micro Systems Inc. (TSXV: KWE) - now rebranding to DEFSEC Technologies Inc - The Tactical Systems Specialist A speculative play in tactical military systems and situational awareness equipment, KWESST represents high-risk, high-reward exposure to Canada's soldier modernization programs.

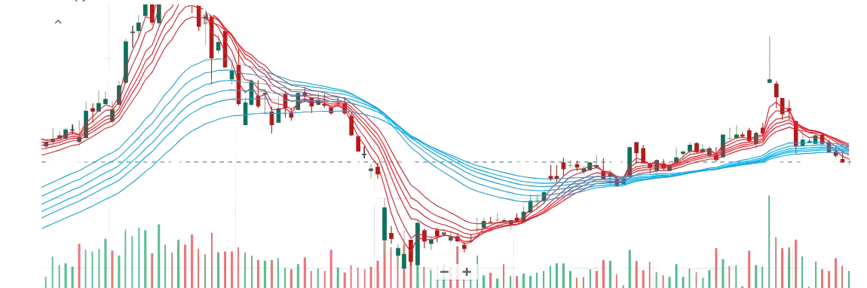

Draganfly Inc. (DPRO,CN)

Share Price: $4.94 CAD

Market Cap: ~$15–20 million USD

Why It Shines: Draganfly’s interoperable drones align with Canada’s UAS priorities for border security and Arctic sovereignty. Growth Outlook: Speculative, driven by DND contracts and innovation funding.

The Mega-Trends Driving Growth

Arctic Sovereignty: The Final Frontier

Climate change is opening new Arctic shipping routes, making Canada's northern territories strategically vital. The $80 billion modernization package prioritizes:

Over-the-horizon radar systems

Ice-capable patrol vessels

Satellite-based surveillance

Arctic-specific drone technology

Domestic Production Revolution

Canada's push for defence self-sufficiency is creating a virtuous cycle:

Reduced foreign dependency

Technology transfer from military to civilian sectors

High-skilled job creation

Export potential for Canadian defence technologies

AI and Autonomous Systems

The modernization package specifically emphasizes:

Unmanned aerial systems (UAS) for border security

AI-powered surveillance and reconnaissance

Autonomous logistics and supply systems

Cyber-resilient communication networks

Investment Thesis: Why Now is the Time

The Perfect Storm of Catalysts:

Policy Certainty: Multi-year defence commitments provide revenue visibility

Technological Edge: Canadian companies lead in niche defence technologies

Undervalued Assets: Many defence stocks trade at discounts to intrinsic value

Export Potential: NATO compatibility creates global market opportunities

Risk Factors to Monitor:

Government spending volatility

Long defence procurement cycles

Regulatory and export control complexities

Geopolitical sensitivity

The Bottom Line: A Geerational Opportunity

Canada's defence renaissance isn't just about military modernization—it's about building a sovereign technological capability that will define the nation's security and economic future for decades.

For investors, this represents a rare opportunity to participate in a government-backed industrial transformation with clear beneficiaries, stable long-term contracts, and significant export potential.

The established players (CAE, Héroux-Devtek, MDA) offer stability and predictable growth, while emerging companies (BlackBerry, Drone Delivery, KWESST) provide higher-risk, higher-reward exposure to breakthrough technologies.

⚠️ Important Disclaimer

This newsletter is intended solely for informational and educational purposes and does not constitute investment advice. The companies mentioned may be subject to high volatility and speculative risk due to various factors, including their dependence on government contracts and shifts in policy, complex regulatory and export control environments, extended development cycles coupled with significant capital requirements, and heightened sensitivity to geopolitical and economic conditions.

Before making any investment decisions, readers are encouraged to conduct thorough research and due diligence, consult qualified financial advisors, consider their individual risk tolerance and investment objectives, and review company financial statements along with relevant regulatory filings. The author assumes no responsibility for any investment losses or decisions made based on the information provided.

💭 Join the Conversation

What's your take on Canada's defence investment opportunity?

Are you betting on the established titans or hunting for the next breakthrough company? Which theme excites you most: simulation and training, space surveillance, cybersecurity, or drone technology?

Key questions we're exploring:

Is CAE's training monopoly sustainable or vulnerable to disruption?

How will MDA's space capabilities perform in an increasingly contested environment?

Can the drone sector live up to its revolutionary potential?

What role should defence stocks play in a diversified Canadian portfolio?

Share your thoughts in the comments below. Whether you're a seasoned defence investor or just exploring the sector, your insights help build a more complete picture of this evolving opportunity.

What defence stock deserves deeper analysis in our next newsletter?