Novo Nordisk A/S (NVO): Can the Weight Loss King Recover from Its Worst Year Ever?

As shares hover near multi-year lows at $57.47, a mounting question about the ability to defend its obesity empire.

Novo Nordisk A/S is a Denmark-based global pharmaceutical leader, and among the world’s largest manufacturers of diabetes and obesity-care medicines. The company operates primarily across Diabetes & Obesity Care and Rare Disease segments and employs about 78,500 people worldwide. It commands global leadership in the GLP-1 category through its blockbuster brands Ozempic and Wegovy.

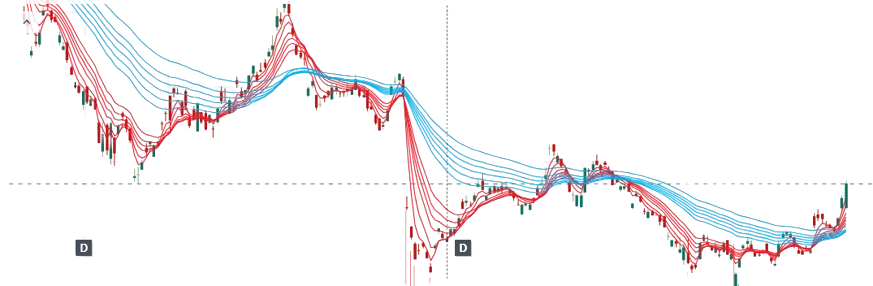

Over the past decade, Novo Nordisk has been a central beneficiary of the global obesity-drug boom. However, 2025 proved to be its most challenging year, with the stock declining nearly 50% from its February peak due to rising competition, clinical setbacks, pricing pressures, and governance changes.

At the current market price of $57.47, the stock trades near multi-year lows, with a market capitalization of approximately $241.8 billion and a dividend yield of 2.23%. The 52-week range of $43.08–$93.80 highlights elevated volatility.

Major Strategic Developments

Launch of Oral Wegovy

In January 2026, Novo Nordisk launched the world’s first oral GLP-1 weight-loss pill, Wegovy, priced at $149 per month for self-pay U.S. patients. Clinical trials showed an average 16.6% weight loss over 64 weeks—on par with injectable Wegovy—while offering significantly greater convenience. The launch meaningfully expands Novo’s addressable patient base and could accelerate obesity drug adoption.

Wegovy Label Expansion into MASH

Wegovy received approval for metabolic dysfunction-associated steatohepatitis (MASH), a large and underpenetrated liver disease market. The only competing approved therapy, Rezdiffra, generated $637 million in the first nine months of 2025, underscoring the revenue potential of this new indication for Novo Nordisk.

Leadership and Governance Reset

In May 2025, the CEO was removed following concerns over market performance. Six months later, all independent board members resigned amid disagreements over U.S. strategy. Mike Doustdar has since assumed leadership and is leading the company’s restructuring and strategic reset.

China Patent Victory with Pricing Trade-off

In December 2025, China’s Supreme Court upheld Novo’s semaglutide patent protection. However, the company cut Wegovy prices by nearly 50% in several Chinese provinces to drive adoption, signaling increasing global pricing and margin pressures.

FINANCIAL PERFORMANCE & FUTURE GROWTH

For the first nine months of 2025, Novo Nordisk reported 290 billion DKK in revenue, reflecting 25% year-on-year growth, while earnings rose 20.70% to 101 billion DKK. Despite these numbers, repeated downward revisions to management guidance damaged investor confidence.

Analysts project revenue growth of 5% annually and earnings growth of 7.30% annually, marking a significant deceleration from prior years. The acquisition of Akero Therapeutics is expected to reduce 2026 operating profit growth by approximately 3 percentage points due to higher R&D spending. Patent expirations in select markets are also expected to have a low single-digit negative impact on global sales growth. Additionally, the acceptance of Medicare Part D pricing controls from January 2027 will place further pressure on U.S. margins.

Pipeline Strength

Novo Nordisk’s long-term growth depends heavily on its pipeline:

CagriSema – Combination obesity and diabetes therapy; NDA filed

Amycretin – Next-generation GLP-1 candidate showing strong Phase-2 efficacy

UBT251 – Triple-agonist drug in early-stage development

Market Expansion Opportunity

The global obesity drug market is expected to exceed $100 billion by 2030. Novo Nordisk currently estimates that around 55 million Americans have Wegovy insurance coverage, including over 10 million Medicaid patients, placing the company in a strong position to benefit from rising obesity treatment adoption.

RISKS, VALUATION & INVESTMENT OUTLOOK

Novo Nordisk faced a perfect storm of negatives in 2025. Semaglutide trials failed to meet primary endpoints in Alzheimer’s disease, eliminating a potentially massive neurological market opportunity. Meanwhile, Eli Lilly’s Mounjaro and Zepbound rapidly gained market share, and Lilly’s oral GLP-1 candidate Orforglipron may gain FDA approval in 2026, threatening Novo’s first-mover advantage.

The U.S. market has also been disrupted by compounded copycat GLP-1 drugs sold through telehealth platforms, increasing price competition and regulatory scrutiny. Manufacturing and supply chain bottlenecks further contributed to repeated guidance downgrades. Combined with global pricing pressures, these challenges resulted in the worst stock performance in the company’s public history.

Valuation at Current Levels

Forward P/E: 12.7x – 14x

Sector average P/E: 17.6x – 18.4x

Trailing EPS: $23.33

This places Novo Nordisk at a historically discounted valuation.

Outlook and Strategic Assumptions

Novo Nordisk’s recovery will depend on the successful rollout of oral Wegovy and the stabilisation of market share in its core obesity franchise. The newly approved MASH indication adds an important incremental growth avenue and strengthens the long-term monetisation potential of Wegovy.

Over the longer term, continued expansion of the global obesity treatment market, combined with the successful commercialisation of next-generation therapies such as CagriSema and broader pipeline progress, will be key to sustaining growth. Improved operational execution and pricing discipline will remain critical to restoring margins and investor confidence, positioning Novo Nordisk to reinforce its leadership in metabolic and obesity care.

Final Verdict

At current levels, Novo Nordisk offers attractive long-term risk-reward. While near-term volatility remains high due to competition and pricing pressure, much of the downside appears priced in. Long-term investors willing to tolerate volatility may find current valuations an attractive entry point.

Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.