🚀 SoFi's Stratospheric Rise: Fintech Rocket or Overvalued Bubble?

From $6 to $21 in 12 Months - Dissecting the Digital Banking Revolution That's Captivating Wall Street

📊 Executive Summary

SoFi Technologies (NASDAQ: SOFI) is a diversified financial services firm operating in the U.S., Latin America, Canada, and Hong Kong. It operates through three segments: Lending, Technology Platform, and Financial Services, offering members the ability to borrow, save, spend, invest, and protect their money. Its lending products include personal, student, and home loans.

SoFi also owns Galileo, a tech platform serving financial and non-financial institutions, and Technisys, a cloud-native core banking platform offering software and support services.

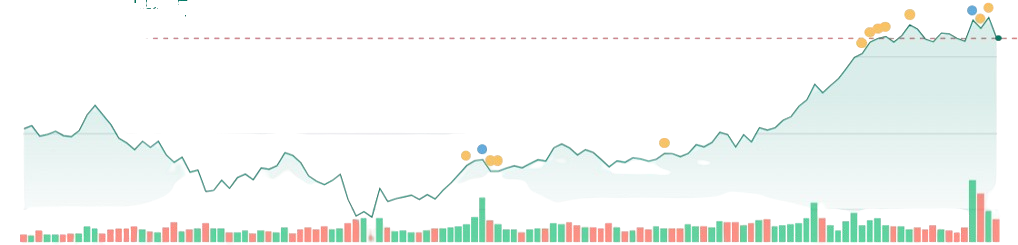

The stock has surged — up 100% since August 2024 and 150% since mid-May, now trading above $21. While SoFi’s growth story is impressive, its premium P/E of 34.90 and execution risks suggest that a closer look is warranted.

🔥 Recent Performance Highlights

Market Momentum:

Current Price: $21.38 | 52-Week Range: $6.01 - $25.11

Market Cap: $24 billion | Gross Margin: 61.10%

12-Month Performance: 100% gains vs. S&P 500's 6.1%

Q2 2025 Breakthrough Results:

Adjusted Net Revenue: $858 million (44% YoY growth)

EPS: $0.08 (beating consensus $0.06 by 33%)

EBITDA: $249 million (81% YoY growth)

💰 Financial Evolution: From Losses to Profits

Revenue Growth Trajectory:

2022: $1.763 billion

2023: $2.912 billion (+65.2%)

2024: $3.766 billion (+29.3%)

Profitability Transformation:

2022 Net Income: -$361 million

2023 Net Income: -$341 million

2024 Net Income: +$498.7 million ✅

💪 Business Moat Analysis

Competitive Advantages:

Digital-First Platform: Comprehensive financial ecosystem

Network Effects: 11.7 million members with increasing cross-sell

Brand Recognition: 60% U.S. market share in student loan refinancing

Revenue Diversification Success:

Lending Segment: $391.9M (traditional strength)

Financial Services: $238.3M (101.5% growth - fastest growing)

Technology Platform: $102.5M (steady 14% growth)

⚠️ Risk Factors & Concerns

Valuation Challenges:

High P/E Ratio: 34.90 vs. traditional financial stocks

Execution Risk: High expectations built into current price levels

Operational Risks:

Interest Rate Sensitivity: Net interest margin declining (5.99% to 5.57%)

Regulatory Scrutiny: $1.1M fine in May 2024 for compliance issues

Technical Warning Signs:

Extended Rally: 150% move may lead to temporary pullback

High Volatility: Beta of 2.46 indicates higher risk than market

🔮 Future Catalysts & Growth Drivers

Positive Catalysts:

Member Growth: Targeting 3 million new members in 2025 (30% growth)

Crypto Expansion: Re-entry into cryptocurrency services and blockchain payments

International Expansion: Self-serve money transfers and global reach

Platform Monetization: Galileo serving 3.4 million federal benefit recipients

💡 Investment Recommendation

Best Risk-Adjusted Entry Strategy: Consider waiting for a pullback to the $19.50–$20.50 support zone. Set a stop loss at $18.50 and aim for an initial target of $24.50. After a recent gain of 34.54%, exercising patience may offer a more favorable risk-reward setup.

For Long-Term Investors:

Entry Range: $18.00–$21.00 (use a scaling-in approach)

Target Range: $28.00–$32.00 with Stop Loss at $15.50

Suggested Holding Period: 3 to 6 plus months

📋 Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.

💬 Let's Talk - Your Voice Matters!

What's your take on SoFi's remarkable transformation?

In the world of high-growth stocks, the conversation is just as valuable as the analysis. Let's build a community of informed investors together!