📊 STOCK SPOTLIGHT: Computer Modelling Group (CMG.TO): A Toronto Stock Exchange listing

Behind the Impressive Revenue Growth Lies Margin Compression and Integration Challenges - A Cautionary Tale for Value Investors

🎯 The Investment Thesis

Computer Modelling Group has spent 40 years perfecting reservoir simulation software for energy companies and now, betting big on becoming a comprehensive energy technology solutions provider through strategic acquisitions. The question: Can they execute this transformation without sacrificing their profitable core business?

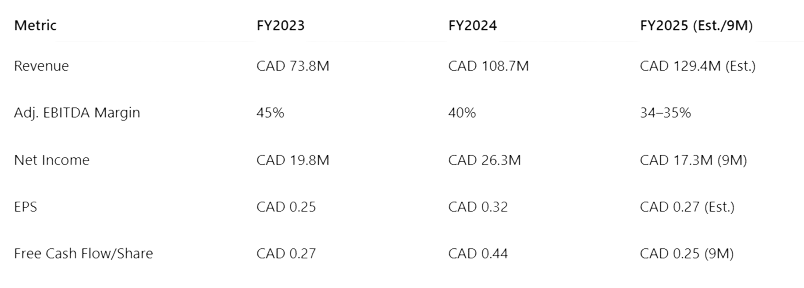

💰 The Numbers That Matte

Revenue Growth: $73.8M (2023) → $129.4M (2025 TTM) = 75% increase

The Problem: EBITDA margins compressed from 45% to 35%

Free Cash Flow: Free Cash Flow declined by 22% year-over-year to $27.6 million, or $0.33 per share, primarily due to increased capital expenditures and integration costs associated with a recent acquisition. This temporary dip reflects strategic investments made to support long-term growth and operational expansion.

Valuation: P/E of 28.7x (vs software industry average of 55x)

✅ What's Working

Sticky Business Model: 70%+ recurring revenue from loyal customers

Market Leadership: Dominant position in specialized reservoir simulation

Energy Transition Exposure: 23% of software revenue from clean energy projects

Strong Balance Sheet: $39.7M cash provides acquisition flexibility

⚠️ The Red Flags

Margin Compression: Core business (43% EBITDA) diluted by acquired seismic operations (15% EBITDA)

Integration Struggles: Multiple acquisitions creating operational complexity

Cyclical Risk: Vulnerable to energy sector spending cycles

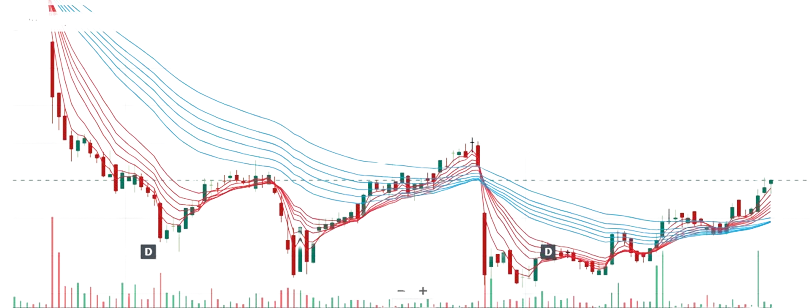

Stock Performance: Down 44.50% over 12 months

🎯 Key Catalysts to Watch

Q4 2025 Results: Will margins show signs of recovery?

Baker Hughes Partnership: June 2025 integration agreement could drive revenue

Energy Transition Wins: New CCS and geothermal project announcements

💡 The Bottom Line

Computer Modelling Group Ltd is executing a logical but risky transformation strategy. The company's specialized software creates high switching costs and recession-resistant revenue streams. However, recent acquisitions have pressured margins and execution remains challenging.

Best For: Patient value investors comfortable with cyclical exposure

Avoid If: You need immediate margin expansion or can't tolerate integration risk

🏆 Investment Verdict

The company's market-leading position and energy transition exposure provide long-term upside potential. However, wait for signs of successful integration before adding new positions.

💰 Target Price Range:

Here is the target ranges derived through AI:

Medium-Term Target (1–3 months):

🔹 ₹11.00–₹11.50, assuming bullish momentum continues past ₹10.80.

Long-Term Target (6–12 months):

🔹 ₹12.00–₹13.00, if the upward trend sustains along with positive fundamentals.

Recommended Action: HOLD for existing investors, MONITOR for potential new positions. Consider accumulating on further weakness if integration challenges show signs of resolution.

Risk Warning: Energy software stocks face cyclical headwinds and integration challenges. Past performance doesn't guarantee future results. Consider your risk tolerance and investment horizon before investing.

💡 Disclaimer:

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.

💬 Let’s Talk!

- Do you believe CMG’s energy transition strategy will offset integration risks?

- Is the current valuation a bargain or a trap given margin pressure?

Share your thoughts below, and let’s discuss CMG’s path forward! 💬