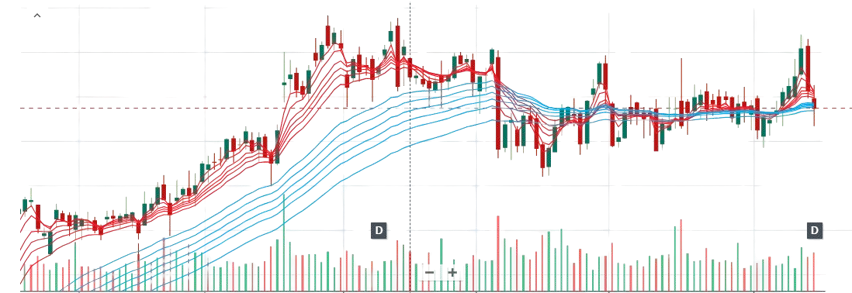

The Charles Schwab Corporation (SCHW) - Is the Rally Built on Shaky Ground?

As SCHW Trades at $94, Deposit Vulnerabilities and Margin Pressures Lurk Beneath Record Earnings

Charles Schwab Corporation posted record financial performance in 2025 with strong revenue growth, wider margins, and rising client assets. Q3 results reflected a sharp rebound in profitability, but structural concerns around deposit stability, duration mismatch, and a shifting business model temper the medium-term outlook. At $94, SCHW appears fairly priced, with upside tied to deposit normalization, private-market expansion, and continued operating leverage.

COMPANY OVERVIEW

Schwab is a leading U.S. wealth-management and brokerage platform with $11.6T in client assets, 46M accounts, and a 400-branch hybrid network. Its Investor Services and Advisor Services segments position the firm as a dominant force in retail brokerage and RIA custody.

RECENT PERFORMANCE & STRATEGIC DEVELOPMENTS

Record Q3 2025 Financial Results

Revenue: $6.1B (+27% YoY)

GAAP EPS: $1.26 (+77% YoY): Adjusted EPS: $1.31 (+70% YoY)

Net Income: $2.4B (+67% YoY)

Client Assets: $11.59T (+17% YoY): Net New Assets: $137.5B (+44% YoY)

Brokerage Accounts: 38M after four quarters of 1M+ new accounts

Forge Global Acquisition – Private-Market Push

The $660M acquisition of Forge Global expands Schwab’s reach in private markets, a segment expected to grow from $4T to $13T by 2032, strengthening long-term growth options.

Operational Efficiencies

Funding costs continue to improve with bank supplemental funding reduced to $14.8B, alongside higher lending utilization and margin gains.

OUTLOOK & GROWTH DRIVERS

Financial Guidance

Revenue growth for 2024 is projected at 3–3.5%, with EPS rising 17.8% YoY on 3.55% revenue growth.

Key Growth Catalysts

Stabilizing client cash balances

Expansion in securities lending

New risk-management tools

Planned crypto-trading launch in 1H 2026

KEY CONCERNS & STRUCTURAL RISKS

Deposit Vulnerabilities (“Cash Sorting”)

Rate-driven cash outflows peaked at $5.6B per month, highlighting sensitivity to interest-rate cycles.

Business-Model Shift

A transition toward off-balance-sheet solutions may reduce deposit risk but could also cap earnings.

Underperformance vs Peers

Schwab’s 11% return in 2024 lagged major indices and rivals like Morgan Stanley.

Interest-Rate Risk

A slower Fed cutting cycle may revive deposit pressure and compress net interest margins.

VALUATION & PRICE TARGETS AT $94

Schwab trades at a P/E of 28 and forward P/E of 22.5, with Street analysts pointing to meaningful upside supported by upgrades from Morgan Stanley, JPMorgan, Goldman Sachs, and Deutsche Bank.

AND

Upside is anchored in deposit stabilization, margin normalization, strong RIA positioning, private-market expansion, demographic tailwinds, and digital innovation, though rate sensitivity remains a key limiter.

INVESTMENT VIEW

Schwab remains a high-quality financial institution with robust asset inflows, rising profitability, and increasing private-market exposure. However, its dependence on rate-sensitive deposits and ongoing balance-sheet restructuring introduce uncertainty to long-term earnings durability.

CONCLUSION

Schwab’s 2025 resurgence demonstrates scale, resilience, and strategic ambition, but its forward trajectory hinges on stabilizing deposits, managing rate exposure, and successfully integrating new revenue channels. With much of its recovery already reflected in the valuation, Schwab offers steady rather than outsized upside, with long-term returns dependent on disciplined execution and a supportive rate environment.

DISCLAIMER

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.