The Vita Coco Company, Inc. (NASDAQ: COCO) - The Coconut Water Craze: Can Vita Coco Sustain Growth Amid Legal Headwinds?

Strong Earnings Can’t Hide Tariff Pressures and Legal Investigations That Cloud the Future

The Vita Coco Company, Inc. (NASDAQ: COCO) develops, markets, and distributes coconut water and related products across major global markets. Founded in 2004 and listed in 2021, Vita Coco dominates the U.S. coconut water segment with a 46% market share — 36% higher than its nearest competitor. Its portfolio includes coconut oil, milk, and functional beverages under brands like Ever & Ever and PWR LIFT.

Recent Financial Performance

Q3 2025: Net sales surged 37% YoY to $182M (vs. $133M), beating estimates by 15%. Core Vita Coco Coconut Water grew 42%, while private label rose 6%. Net income increased to $24M, topping expectations by 36%.

Margins Under Pressure: Gross margin slipped 110 bps to 38% due to elevated import tariffs and higher input costs.

Balance Sheet: Cash reserves of $203.7M, no debt, and $42M remaining under buyback authorization position the company strongly.

Recent Developments

Raised FY25 Guidance: Net sales forecast lifted to $580–595M; Adjusted EBITDA expected at $90–95M.

Product Innovation: Vita Coco Treats drove 182% growth in the “other” category and attracted new consumers.

International Strength: Overseas sales surged 48%, with the UK holding over 80% share in its category.

Negative Developments

Legal Investigation: Multiple law firms launched securities fraud probes after a short seller alleged loss of the Costco contract, potentially cutting $90M in revenue. The stock fell 11% on the news in March 25.

Tariff & Margin Compression: FY25 gross margin expected near 36%, it was 41% last year.

Insider Selling: CMO Jane Prior sold 10,000 shares post-exercise, raising governance concerns.

Market Position & Competition

Vita Coco commands ~42% U.S. share, outpacing Coca-Cola, PepsiCo, and private labels. The global coconut water market is growing at a 17% CAGR (2025–2030) toward a projected $11.4B size. Reduced competition from beverage giants supports leadership, but category differentiation remains thin.

Growth Drivers vs. Headwinds

Tailwinds:

Vita Coco’s growth is underpinned by expanding international markets —alongside successful product diversification through Vita Coco Treats. With coconut water still underpenetrated, the category offers ample room for expansion, while a recovery in the private-label segment by FY26 adds to its growth visibility.

Headwinds:

Vita Coco faces key challenges, including tariff-driven cost inflation that continues to pressure margins. Ongoing legal investigations and uncertainty surrounding the Costco contract add further risk, while the stock’s elevated valuation leaves little margin downside protection.

Valuation & Price Outlook

At around $42 per share, Vita Coco commands a market capitalization of nearly $2.4 billion and trades at premium valuation multiples — 34–42× earnings, 26–28× EV/EBITDA, and roughly 4× sales. These elevated multiples underscore investor confidence in the company’s growth trajectory and margin recovery potential, though they also leave limited margin for error amid ongoing legal and tariff-related overhangs.

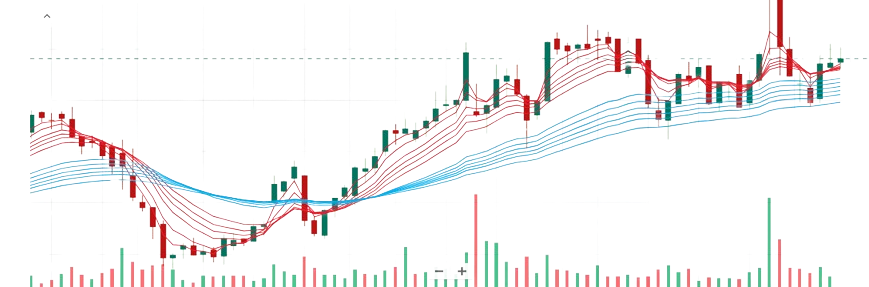

Technical View

The stock remains in a Stage 2 (advancing) phase, consolidating within an established uptrend. Price action shows mild short-term congestion but no signs of structural weakness. A decisive breakout above recent highs, supported by rising volume, would reaffirm bullish momentum and potentially set up for the next leg higher.

Investment View

At current levels, Vita Coco appears fairly valued, reflecting its strong market leadership, growth visibility, and operational resilience. While margin pressures and legal uncertainties temper near-term upside, the company’s solid balance sheet, expanding international reach, and innovation-driven portfolio support a constructive long-term outlook.

Investors with a multi-year horizon may consider accumulating on dips, as Vita Coco remains a structurally strong franchise in a high-growth, health-focused beverage category with meaningful global scalability.

Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.

Let’s Talk

Will Vita Coco’s resilience outlast its legal and cost challenges?

Share your take — is it a buying opportunity or value trap?