🩺 WELL Health Technologies (TSX: WELL) - Digital Disruption or Distress Signal?

Glowing Revenue but Growing Risks _ Behind the Billion-Dollar Milestone Lies a Margin Pressure & Uncertainty!

📌 Executive Snapshot

WELL Health Technologies Corp is Canada’s poster child for digital healthcare, having achieved a CAD 1 billion annualized revenue run-rate. Yet, beneath this shiny surface lie significant red flags: revenue recognition delays, audit postponements, profitability concerns, and a slowing growth engine. As investors look for clarity, the question remains — is WELL a digital healthcare disruptor or a cautionary tale?

🏥 Business Model & Segments

WELL, is a vertically integrated health-tech platform operating across:

Canadian Primary Care Clinics

U.S. Virtual Care (Circle Medical, CRH)

SaaS & EMR Technology Services

AI and Digital Health Tools (via HEALWELL AI)

The business model leverages acquisitions, clinic absorption, and recurring tech revenues to drive growth.

📊 Financial Performance Review

🔹 FY 2022–2025 Overview

Highlights:

Revenue CAGR over 5 years: 40%+

OPM dropped due to integration costs, deferred revenue

Free Cash Flow and cash from operations have improved steadily

ROCE dipped in 2024 due to capex and Circle Medical revenue delays

⚙️ Recent Developments & Red Flags

✅ Positives:

Achieved C$1B run rate early

Adjusted EBITDA: C$34.1M in Q1 2025 (+21% YoY)

Record patient visits (2.6M in Q1 2025)

Integration of Harmony Anesthesia & HEALWELL AI

Launched AI-powered co-pilot for cardiologists

🚨 Concerns:

Revenue Deferrals: C$56.6M deferred from Circle Medical

Audit Delays: Late filing of 2024 financials due to U.S. subsidiary issues

Profitability: Net income still negative (Q1 2025: –C$46.57M)

Regulatory Scrutiny: Circle Medical under U.S. DOJ review

🛡️ Moat & Market Position

Moat Elements:

Network Effect: WELL, operates the largest Electronic Medical Records (EMR) and outpatient clinic network in Canada, fostering strong user retention and ecosystem stickiness.

Technology Ecosystem: A comprehensive suite of SaaS products, EMR platforms, and AI tools creates high switching costs and deep integration within client operations.

Brand Trust: Established brand reputation and credible leadership enhance investor confidence and stakeholder trust.

Moat Vulnerabilities:

Acquisition-Heavy Model: Rapid expansion through acquisitions exposes the business to integration risks and financial strain.

Regulatory Exposure: U.S. operations face heightened regulatory scrutiny, introducing compliance and reputational risks.

Limited Pricing Leverage: Outside of its core Canadian market, the company faces challenges in commanding premium pricing or scale advantages.

💪 Strengths

Market Leadership: Dominant player in Canada’s digital health space with a wide footprint of clinics and tech integrations.

Diversified Revenue Streams: Balanced mix of clinical services, SaaS offerings, and virtual care across geographies.

AI Growth Levers: Scalable partnerships and in-house AI development (e.g., HEALWELL AI) set the stage for future monetization and differentiation.

📉 Weaknesses

Transparency Issues: Recurring problems with deferred revenue and delayed audits raise governance and reliability concerns.

Margin Compression: Operating margins have declined due to high integration costs and revenue deferrals.

M&A Dependence: The business model relies heavily on continuous acquisitions, increasing financial and operational complexity.

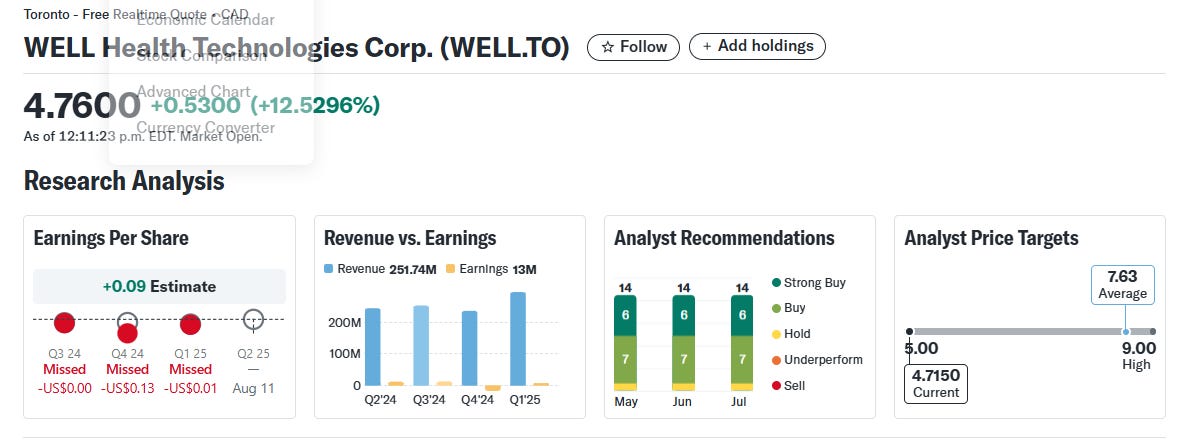

🧭 Technical & Valuation Outlook

Stock Price: C$4.06 (June 30, 25), down 13% YoY, Price C$ 4.72 (July 08, 25)

Forward P/E: ~40×; Current P/E: ~13.8

P/S: Low relative to revenue

MACD & RSI: Bullish divergence forming

Valuation: Analyst targets C$7.45–C$8.67 (upside ~90%)

Refer Analyst Ratings, Estimates & Forecasts - Yahoo Finance for details~~

Takeaway: Technically oversold, but earnings clarity and audit resolution are key to unlocking upside.

Here are some more key bullet points summarizing the corporate update from WELL Health Technologies:

🏥 Clinic Acquisitions & Pipeline

Two new clinics acquired on July 1, 2025, adding:

C$12 million in annual revenue

C$3 million in Adjusted EBITDA

So far in 2025, 13 clinics acquired, totaling C$33 million in annual revenue.

Current M&A pipeline:

5 active LOIs covering 7 clinics (C$27M in revenue, C$3.5M in EBITDA)

Broader pipeline includes 27 targets / 124 clinics (C$370M revenue, C$50M EBITDA)

🏦 Expanded Credit Facility

Credit facility with RBC extended to 2027.

Converted accordion feature into a revolver, increasing flexibility.

New total capacity: C$200 million (C$70M available)

⚙️ Cost Optimization Initiative

Launched a multi-million-dollar cost optimization program to modernize and digitize clinics.

Focused on efficiency, patient access, and physician recruitment.

Over 50,000 new patient openings created across 4 provinces.

🌐 Strategic Commentary

Continued organic + inorganic growth is driving WELL’s national scale.

Focus on improving patient care, clinic efficiency, and operational excellence.

Two latest acquisitions include:

A personalized health clinic in Vancouver (boosting longevity & preventive care)

A large multi-specialty clinic in Burnaby (including pediatrics, neurology, dermatology)

🔚 Conclusion: A Double-Edged Sword

WELL Health is a compelling bet on digital healthcare, its vision is impressive, and the runway remains long. But the accounting missteps, profit challenges, and high valuations cloud the picture.

🟨 Final Verdict: HOLD with caution

Buy on dips only after signs of margin stability and regulatory clarity. Not for conservative investors, but growth-seekers willing to ride volatility may find WELL’s AI-led roadmap enticing.

📌 Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.

💬 Let’s Talk

Are you buying the dip in WELL, or waiting for more clarity?

What’s your take on Circle Medical’s accounting fiasco—oversight or systemic issue?

Do you trust WELL’s AI expansion and tech pivot, or is it smoke and mirrors?

Drop your thoughts, debate your views, and share your insights below. Let’s crowdsource conviction!