Why I Bought "Hims & Hers" at the Cliff Edge — Why It Might Just Be a Brilliant Long-Term Play

"Catching the Crash: Betting on the Bounce of HIMS"

In January 2025, NVIDIA’s stock faced a brutal correction, plummeting from its pre-crash high of around $142 to an intraday low of approximately $118 on January 27th—the day Chinese startup DeepSeek unveiled its R1 AI model. While the stock saw modest technical rebounds, but broader market concerns continued to weigh it down, driving NVIDIA to a deeper low of just $94.21 by April 2025. We have missed the opportunity to enter and currently NVIDIA is trading above $150.

"History seems to be repeating itself with another intriguing setup in Hims & Hers Health (NYSE: HIMS)."

🚨 The Trigger: A Strategic Bet Amid Chaos

On June 24, 2025, I bought Hims & Hers Health at $43.51, shortly after its dramatic 35% drop following the termination of its partnership with Novo Nordisk. This decision came at a moment of extreme pessimism, sparked by allegations of illegal compounding of Semaglutide and a regulatory spotlight on the company’s weight-loss offerings.

The sentiment was grim, with media and social media channels flooded with fears of legal liabilities and class-action lawsuits. But I saw something else: a fundamentally solid company experiencing a short-term storm.

📉 What Happened?

🔻 The Crash:

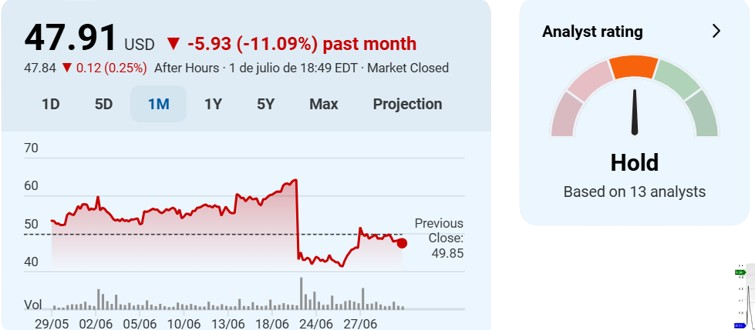

On June 23, HIMS stock plunged from $64.22 to $41.97.

Reason: Novo Nordisk accused Hims & Hers of violating FDA rules around compounded semaglutide (Wegovy).

Result: 34.6% loss in one day—its steepest decline since IPO.

📊 The Numbers That Matter

Despite the recent controversy, HIMS continues to showcase strong underlying fundamentals. In Q1 2025, the company reported a revenue of $586 million, reflecting an impressive 111% year-over-year growth. Net income surged by 346% to reach $49.5 million, underlining significant profitability improvements. The subscriber base also expanded marking a 38% increase.

HIMS provided a 2025 revenue guidance of $2.3 to $2.4 billion, indicating a projected growth of 59% to 64% compared to the previous year. Looking ahead, the company has set an ambitious target for 2030, aiming to achieve $6.5 billion in revenue and $1.3 billion in adjusted EBITDA. Notably, the company operates with no debt and continues to generate strong cash flows, underscoring its solid financial position and long-term growth potential.

👉 The company's subscription model, high retention, and product diversification (skincare, mental health, hair care) provide revenue stability even as semaglutide-related revenue ($725M expected in 2025) faces headwinds.

📈 Why I Bought the Dip

Oversold Territory: Technical indicators like RSI showed short-term bottoming signals. The stock rebounded 18% to $49.48 by June 27, confirming momentum.

Still a Growth Beast: Despite the regulatory friction, HIMS has grown revenue 10x in 5 years. No debt, strong OCF, and loyal customers with $84 ARPU give it room to absorb setbacks.

Long-Term Vision Is Intact: By 2030, management envisions HIMS becoming a $6.5B global healthcare platform—driven by AI personalization, geographic expansion, and chronic disease management.

⚖️ Risks You Can’t Afford to Overlook

While the long-term outlook for the company remains compelling, investors should be mindful of several key risks and red flags:

Semaglutide Dependence: This drug has been central to HIMS' rapid growth in the weight-loss segment, but overreliance could pose challenges.

Regulatory Pressure: Increased FDA scrutiny on compounded medications is intensifying. The termination of the Novo Nordisk partnership serves as a cautionary tale.

Legal Clouds: Ongoing securities investigations and class-action lawsuits may continue to cast a shadow in the near term.

Margin Pressure: Gross margins have slipped notably — from 82% in FY2023 to 73% in Q1 2025 — a trend worth watching.

Stretch Valuation: Trading at 40–63× forward P/E, the stock is priced for perfection, leaving little room for error.

That said, price is what you pay, value is what you get — and at $43.51, I saw opportunity amid the chaos.

📬 My Thesis in a Nutshell

Short-term: Volatile, headline-sensitive, high-beta stock under legal fog.

Mid-term: Stabilization through diversified revenue and digital health tailwinds.

Long-term: Potential multi-bagger if execution on global scaling, AI, and chronic care continues.

⚠️ Disclaimer

This information and sharing are for educational purposes only and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed other than a small position in one of the family accounts at the time of writing.

💬 Let’s Talk About It!

Did I time it right or walk into a legal minefield?

Do the fundamentals justify taking on this regulatory heat?

Would you consider HIMS a long-term hold or wait for another dip?

🔁Hit "Reply" or comment below—I’d love to hear your take!