Why The Trade Desk, Inc. (NASDAQ: TTD) Could Be Facing Static - Still Tracking the Signal, or Losing the Frequency?

Growth darling turned cautionary tale — can it regain momentum or is the noise too loud?

The Trade Desk, Inc. (TTD) is a leading U.S. advertising technology firm offering a cloud-based, self-service platform that helps advertisers and agencies plan, buy, and optimize digital campaigns across channels—display, video, audio, CTV, and out-of-home. It has built a reputation as the “independent anti-walled garden,” competing against tech giants like Amazon, Google, and Meta.

Recent Developments

Leadership Changes: Vivek Kundra (COO, Mar 2025) and Alex Kayyal (CFO, Aug 2025) appointments mark a strategic reshuffle.

Product Initiatives: Launch of OpenSincera (supply-chain visibility tool) and continued expansion of Unified ID 2.0 (UID2) for identity management.

Market Reaction: Shares plunged ~38–40% post-Q2 results amid concerns of slowing growth and rising competition.

Financials: Gross margin at ~79.4%, debt-to-equity ratio 12.7%, and earnings forecast growth ~20.8% annually. Simply Wall St estimates the stock trades ~46% below fair value.

Outlook & Growth Prospects

Tailwinds:

Expansion of CTV, retail media, and AI-driven targeting (Kokai platform).

High client retention and scalable margins.

Strong balance sheet supports R&D and strategic bets.

Headwinds:

Growth slowdown (19% → 14%) and fierce DSP competition from Amazon and Netflix partnerships.

Execution risk in scaling new platforms (e.g., Kokai, Ventura OS) amid market impatience.

Valuation & Outlook (Current Price: USD 50.28)

The Trade Desk’s valuation reflects a mix of strong strategic positioning and emerging operational challenges. Over the long term, sustainable value creation hinges on successful execution in AI-driven advertising, identity frameworks, and connected TV (CTV). Based on plausible earnings progression and normalized multiples, the stock’s intrinsic value appears well supported by its growth potential, albeit with execution risk.

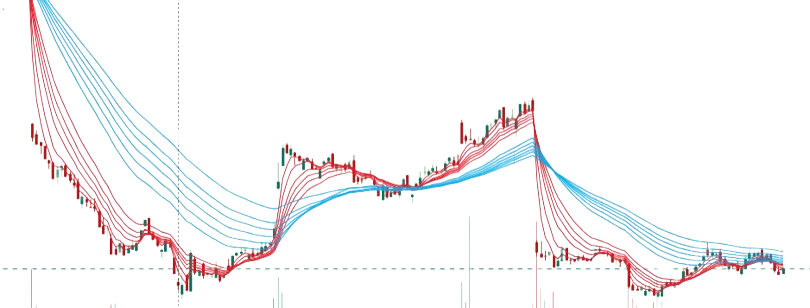

The chart of The Trade Desk (NASDAQ: TTD) shows that the stock has moved through a Stage 4 decline and is now in a late Stage 1 consolidation phase. A brief Stage 2 breakout attempt failed, leading to renewed sideways action as short- and long-term GMMA ribbons compress. Overall, the stock is base-building but has yet to confirm a new uptrend.

Final Take

The Trade Desk remains a pivotal independent player in the global ad-tech ecosystem, underpinned by its platform strength, expanding CTV footprint, and leadership in programmatic advertising. Maintain a constructive long-term view. Investors with a high-risk appetite and multi-year horizon may consider gradual accumulation, while more conservative participants should await clearer signs of margin recovery and consistent growth momentum before increasing exposure.

Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.

Let’s Talk

Do you see The Trade Desk’s plunge as a long-term buying window or a warning sign of deeper issues?

Share your thoughts — let’s discuss!

The pullback from $120 to $50 looks like an overreaction when you consider the funamentals are still intact. CTV growth is accelerting faster than most people realize, and Kokai could be a game changer if execution delivers. The independant positioning against walled gardens becomes more valueable as advertisers demand more contol over their spend.