Company Overview

Agnico Eagle Mines Ltd. is one of the world’s leading gold producers with operations in Canada, Australia, Finland, and Mexico, supported by exploration in Latin America and the U.S. The 2022 merger with Kirkland Lake Gold strengthened its long-life portfolio with Detour Lake, Macassa, and the high-grade Fosterville mine.

Agnico’s Tier-1 jurisdiction exposure, strong reserve base, and growth pipeline position it as a high-quality senior gold miner—though current valuation leaves limited margin for error.

Recent Performance & Strategic Developments

Q3 2025: Record Results

Agnico reported one of its strongest quarters:

EPS: $2.16 vs. $1.95 (10.8% beat): Revenue: $3.06B vs. $2.95B

Free Cash Flow: $1.2B: Debt Reduction: $400M repaid

The company also launched Avenir Minerals, holding $80M in critical mineral assets with $50M additional funding.

Key Risks & Emerging Challenges

· The stock trades at a premium to DCF fair value (intrinsic value and above peer multiples.

· Gold Price pullback could Erode margins, Reduce cash flows and Trigger sentiment reversal.

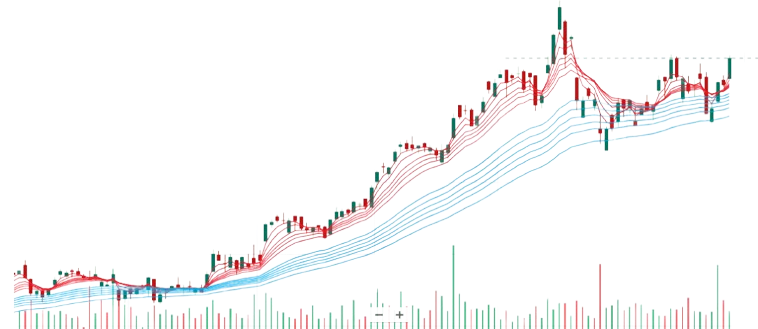

Technical Positioning & Market Structure

Agnico Eagle remains in a strong uptrend within a well-defined ascending channel, though the stock is now trading near the upper boundary, suggesting stretched conditions and ongoing consolidation around CAD 243–244.

Volume continues to support the trend, and momentum remains bullish, but indicators are entering overbought territory, limiting near-term upside without a fresh catalyst.

Medium-Term Target

Agnico Eagle’s medium-term target of CAD 260–285 is supported by the potential for a breakout above CAD 245, gold prices holding above USD 3,800/oz, and production growth from the Hope Bay restart and Detour Underground ramp-up.

Analyst targets averaging around CAD 273 and strong earnings momentum also reinforce the outlook. However, risks such as stretched valuation, ongoing ESG issues, inflationary cost pressures, and commodity volatility remain significant.

Long-Term Target

Agnico Eagle’s long-term target of CAD 320–380 is supported by a bullish outlook for gold potentially rising to USD 4,200–5,400/oz, with extreme scenarios reaching USD 6,200. The ramp-up of Hope Bay and Detour Underground—adding over 300,000 oz annually—combined with future free cash flow potential exceeding $2B per year, strengthens the multi-year growth case.

Long-term technical projections also point toward the CAD 350–380 zone. The outlook carries an estimated 50% probability, highly dependent on a sustained gold Supercycle and consistent operational execution.

Investment View: A High-Quality Miner at a High-Stakes Moment

Agnico remains a high-quality operator with strong assets, rising production, and supportive gold market tailwinds, but the current valuation assumes a near-perfect backdrop of strong gold prices, flawless execution, and smooth ESG outcomes.

Existing investors can maintain their positions and New investors should avoid chasing the rally and look to accumulate only on meaningful pullbacks toward CAD 210–220, or modest dips to 220–230. In summary: an excellent business at an elevated price—upside remains, but downside risks also open.

Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.