JAKKS Pacific, Inc. (NASDAQ: JAKK), a leading U.S.-based toy manufacturer, trades around $29, up 31% YTD vs. the S&P 500’s 13% gain. The company boasts a debt-free balance sheet and a 3.4% dividend yield, but its Q2 stumble raises concerns about long-term sustainability.

Recent Developments

Credit Facility Refinancing: Shift to cash-flow-funded structure; signals both resilience and caution on cash generation.

International Growth: Europe up 65%, Latin America up 20%, partially offsetting U.S. weakness.

Debt-Free Status: All long-term debt cleared in 2023; preferred stock repurchased.

Red Flags

JAKKS Pacific faces several headwinds that warrant caution. The company reported a Q2 statutory loss of $0.21 per share, with EBITDA plunging 81% year-over-year, highlighting profitability pressures. Its Costume segment continues to underperform, declining 12% in Q2, while tariff-related import cost volatility remains an ongoing risk. Additionally, the sharp inventory build-up raises concerns of potential write-downs if retail sell-through fails to improve, further straining margins and cash flows.

Valuation & Outlook

JAKKS Pacific currently trades at attractive levels, with a valuation of approximately 0.34x Sales and 3.4x EBITDA, positioning it at a significant discount to industry peers. Analyst price targets range between $27 and $40, offering potential upside of nearly 38% at the higher end.

Scenario Outlook:

Base Case ($32–$35): Stabilization of U.S. sales combined with continued international growth.

Bull Case ($40–$45): Strong product launches, successful holiday season, and further international traction.

Bear Case ($22–$25): Persistent U.S. weakness, tariff pressures, and potential dividend risks.

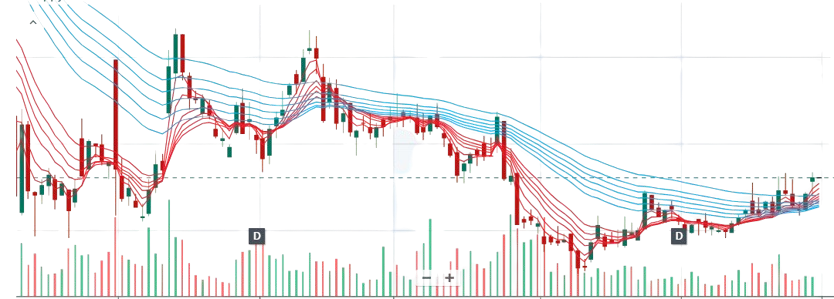

So JAKKS represents a high-risk, high-reward opportunity. Its key strengths include a debt-free balance sheet, growing international footprint, and compelling valuation multiples. Technically, the stock appears to be at an inflection point, showing signs of trend reversal with potential to build higher highs in the coming quarters.

For investors with higher risk tolerance, it can be approached as a “buy-on-dips” opportunity, averaging positions strategically to capture the improving risk-reward setup. Conservative investors, however, may prefer to wait for greater confirmation of U.S. market stabilization before committing fresh capital.

Disclaimer

This report is for educational purposes only and not investment advice. Investors should conduct their own due diligence or consult a licensed advisor before making decisions. Information is sourced from public filings and analyst data believed reliable but may contain errors or bias.

LET’S TALK – Share your thoughts on whether JAKKS is a turnaround opportunity or a value trap.