🚀 The Big Picture

ARK Invest has positioned itself as the gateway to tomorrow's economy today. Under Cathie Wood's visionary leadership, ARK's ETF suite captures the exponential growth potential of artificial intelligence, genomics, fintech, robotics, and space exploration—the very technologies reshaping our world.

💡 The ARK Advantage

Pure-Play Innovation Exposure: Unlike traditional funds that dabble in disruption, ARK goes all-in on transformative technologies with 30-50 concentrated positions per fund.

Active Management Edge: Benchmark-agnostic approach with dynamic rebalancing based on innovation trajectories, not market cap weightings.

Convergence Strategy: Focus on intersecting technologies that amplify each other's impact—think AI-powered genomics and autonomous fintech solutions.

📊 Performance Snapshot: The Numbers That Matter

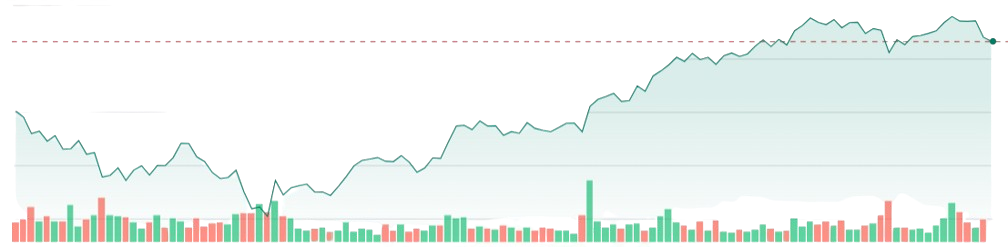

• ARKK - ARK Innovation ETF

Multi-theme disruptive innovation across AI, robotics, genomics, energy storage

1-Year Return: 75.34% | 3-Year CAGR: 13.85% - 20.71%

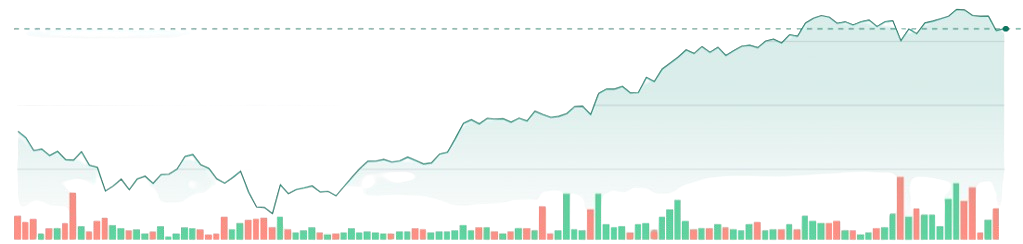

• ARKW - ARK Next Generation Internet ETF

Cloud computing, AI infrastructure, digital media, blockchain technologies

1-Year Return: 106.76% | 3-Year CAGR: 35.68% - 44.40%

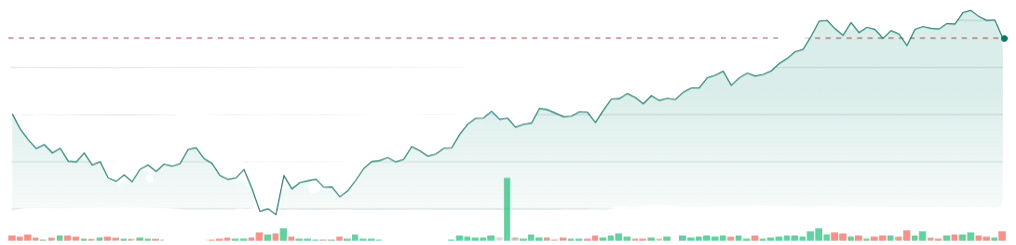

• ARKF - ARK Fintech Innovation ETF

Digital payments, blockchain, neobanking, financial technology disruption

1-Year Return: 98.24% | 3-Year CAGR: 37.39% - 48.06%

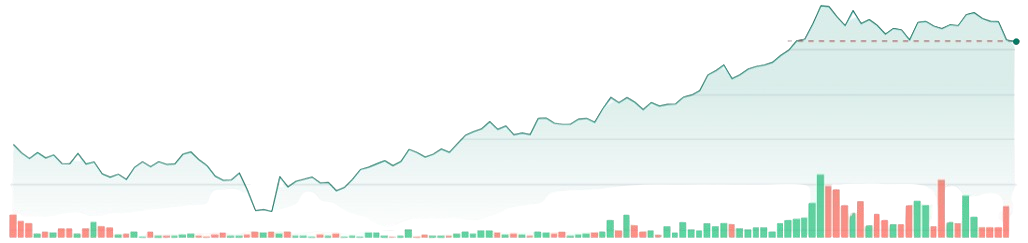

• ARKQ - ARK Autonomous Technology & Robotics ETF

Autonomous vehicles, industrial robotics, automation, AI-driven manufacturing

1-Year Return: 82.03% | 3-Year CAGR: 18.31% - 23.75%

• ARKX - ARK Space Exploration & Innovation ETF

Satellite technology, space infrastructure, orbital economy development

1-Year Return: 78.03% | 3-Year CAGR: 8.21% - 18.26%

⚡ The Reality Check

High Voltage, High Reward: ARK ETFs deliver 25-40% annual volatility with potential drawdowns of 40-70%. This isn't your grandparents' conservative portfolio—it's rocket fuel for patient growth investors.

Time Horizon Critical: These funds are engineered for 5-10 year investment cycles, aligning with technology adoption curves and market maturation timelines.

🎯 Who Should Buckle Up

The Ideal ARK Investor:

Comfortable with portfolio swings of 30-50%

Seeks alpha generation over capital preservation

Believes in the transformative power of disruptive innovation

Has the patience for long-term wealth creation

🔮 Forward-Looking Expectations

Conservative Scenario: 8-12% long-term CAGR with moderate volatility Optimistic Scenario: 12-15%+ CAGR during favorable innovation cycles Reality: Expect wild rides with potentially spectacular destinations

💎 The Bottom Line

ARK Invest ETFs are more than just investments—they’re stakes in the future. For growth-oriented investors with a high-risk appetite and a long-term perspective, ARK provides unmatched exposure to the technologies set to define tomorrow.

This is a strategy built for patient investors who systematically add through SIPs or buy on market dips, using dollar-cost averaging to turn short-term volatility into long-term opportunity.

Every correction becomes a chance to accumulate at attractive valuations. The real question isn’t whether disruptive innovation will transform global markets—it’s whether you’ll have the conviction to stay invested and seize these once-in-a-generation opportunities.

Investment Disclaimer: This analysis is for educational purposes only. Innovation investing carries substantial risk including potential loss of principal. Past performance does not guarantee future results. Consult qualified financial professionals before making investment decisions.

Ready to discuss the future of innovation investing?

Share your thoughts on ARK's approach to capturing tomorrow's growth today.