🏢 Company Overview

Celestica Inc is a global leader in advanced supply chain solutions, operating across North America, Europe, and Asia. The company’s two main segments are:

Connectivity & Cloud Solutions (CCS): Focused on hyperscalers and data center infrastructure

Advanced Technology Solutions (ATS): Serves aerospace, defense, healthcare, and industrial sectors

Celestica offers complete lifecycle support—from design and prototyping to manufacturing, assembly, logistics, and after-market services.

🔍 Executive Snapshot

Market Cap: CAD 21.47B

Celestica has capitalized strongly on the AI infrastructure boom. The CCS segment surged 99% YoY in Q1 2025, pushing both revenue and EPS to record levels. However, with the stock price more than doubling in 12 months, investors are asking—how much more upside is left?

📊 Q1 FY2025-26 Highlights (Ended March 2025)

Revenue: CAD 2.65B (+20% YoY)

Adjusted EPS: CAD 1.20 (+44% YoY)

Free Cash Flow: CAD 94M (+39% YoY)

🔮 2025 Outlook

Full-Year Revenue Estimate: CAD 10.85B (+12% YoY)

Adjusted EPS Estimate: CAD 5.00 (+30% YoY)

Projected Free Cash Flow: CAD 350M

Q2 Guidance: Revenue CAD 2.675B–2.825B | EPS CAD 1.15–1.30

🧠 Strategic Positioning: Strengths vs Weaknesses

✅ Strengths

Explosive AI Infrastructure Demand: CCS segment is a direct beneficiary of AI server and data center buildouts.

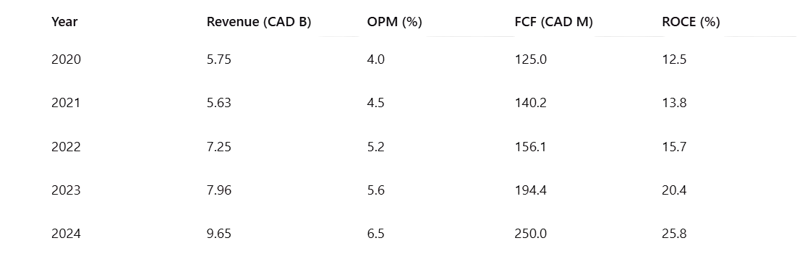

High Capital Efficiency: ROCE of ~25.8%, with consistently rising free cash flows.

Solid Balance Sheet: Low debt (0.4x D/E) and robust cash generation support ongoing buybacks and strategic flexibility.

Global Operational Scale: Engineering, design, and manufacturing capabilities across three continents.

Deep Hyperscaler Integration: Entrenched in cloud ecosystems, giving it a first-mover advantage in AI switching and high-speed interconnects.

Moderate Moat: Built on customer stickiness, technical agility, and global delivery infrastructure.

❌ Weaknesses

Customer Concentration: Two hyperscalers account for 37% of revenue—making earnings sensitive to their capex cycles.

Low Margins & Commodity Pressure: As an EMS provider, Celestica operates in a commoditized space with limited pricing power.

ATS Growth Lag: Macro slowdowns in industrial and healthcare segments are limiting ATS expansion.

Valuation Risk: The stock trades well above its fair value estimate, raising concerns about overpricing.

🚀 Growth Opportunities

Edge AI & High-Speed Switching: Product innovation like the DS4100 platform positions Celestica well in the AI switching market.

Acquisition-Led Expansion: M&A activity (e.g., NCS Global) extends footprint in high-growth verticals.

Secular Tailwinds: Part of a broader $1.6T AI infrastructure investment cycle over the next 5–7 years.

⚠️ Key Risks & Threats

Capex Normalization: If hyperscalers slow down their infrastructure spending, Celestica could face demand compression.

Competitive Intensity: Faces stiff competition from larger EMS players like Flex, Jabil, and Foxconn.

Geopolitical and Supply Chain Disruptions: Tariffs, raw material volatility, and interest rate spikes can disrupt margins and delivery schedules.

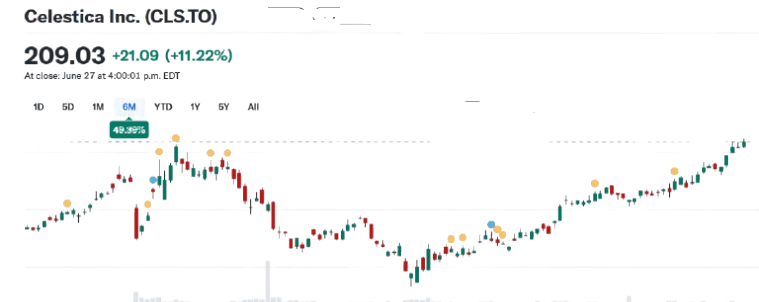

📉 Valuation & Technicals

As of June 28, 2025, Celestica Inc. is trading at CAD 209.03, marking the upper limit of its 52-week range, which spans from CAD 94 to CAD 209.03. The stock’s 14-day Relative Strength Index (RSI) stands at 69, indicating it is approaching overbought territory. Technical indicators remain strong, with a bullish crossover in the MACD, signaling continued upward momentum.

💡Interpretation: Technically bullish but fundamentally stretched. Investors may consider pullbacks to CAD 180 or lower for a better risk-reward entry.

📚 Historical Financials Snapshot

👥 Ownership Structure

Celestica Inc has a high institutional ownership, with approximately 92% of its shares held by large financial entities. Among the top stakeholders, BlackRock holds around 10.2%, followed by Vanguard with 8.5%, and Fidelity owning approximately 6.3%. The retail float remains limited at about 8%, highlighting the stock's dominance among institutional investors. Notably, Onex Corporation, a key promoter, fully exited its position by the third quarter of 2023, marking a significant shift in the company’s ownership structure.

✅ Final Verdict: HOLD with CAUTION

Fair Value Estimate: CAD 169.94

Buy Zone: CAD 180 or lower

Risk Level: Medium–High

Celestica is executing well in a red-hot AI market, but valuations are reflecting near-peak expectations. Investors should avoid chasing the rally and instead wait for opportunities during market pullbacks.

📌 Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.

🗣️ Join the Conversation

Where do you see Celestica in the next 12 months? Still in liftoff mode, or due for a cool-down?

💬 Let us know: Breakout story—or bubble in the making?