Introduction

Today we're analyzing GitLab Inc., ticker G-T-L-B, a DevSecOps platform leader currently trading at $45 with a $7.46 billion market cap. The company trades at 9.1 times price-to-sales, representing a premium valuation that demands careful scrutiny.

Company Overview

GitLab provides an end-to-end software development platform covering the entire DevSecOps lifecycle - from planning and coding to security testing and deployment. What sets them apart is their integrated approach, helping enterprises reduce tool sprawl by managing everything through a single platform.

Recent Performance

Looking at Q1 fiscal 2026 results, GitLab delivered solid but decelerating growth. Revenue hit $214.5 million, up 27% year-over-year, though this represents a slowdown from their historical 50% compound annual growth rate. The company maintains strong enterprise traction with over 50% Fortune 100 penetration and an impressive 122% dollar-based net retention rate.

On profitability, there's progress but challenges remain. Operating cash flow reached $106 million in Q1, while adjusted free cash flow hit $104 million. However, GAAP free cash flow was negative $60 million for fiscal 2025, and return on capital employed remains persistently negative.

Competitive Landscape

GitLab's key advantage lies in AI integration through their GitLab Duo platform, which they've strategically seeded across premium tiers for future monetization. Their enterprise moat comes from high switching costs and network effects from a large developer community.

However, Microsoft GitHub poses an existential threat with deep pockets, Azure integration, and massive ecosystem advantages. The open-source foundation that drives adoption also creates vulnerabilities by enabling feature replication.

Investment Framework

The bull case centers on platform consolidation trends favoring single-vendor solutions, AI differentiation creating pricing power, and high enterprise switching costs providing predictable growth.

The bear case highlights Microsoft's ecosystem advantages, unsustainable growth deceleration as markets mature, and fundamental business model challenges indicated by negative return on capital.

Price Targets and Outlook

For the medium term of 3 to 6 months, we see a bull target of $62 to $65, base case of $55 to $60, and bear case of $40 to $42. The key breakout level sits at $52.

Long-term targets over 6 to 12 months range from $70 to $75 in the bull case, $55 to $65 base case, with major support around $35 to $40.

Critical Monitoring Points

The immediate focus should be on AI monetization progress - Q2 fiscal 2026 must show tangible adoption beyond seeded usage. We're also watching competitive responses from Microsoft and GitHub, particularly around AI integration and pricing.

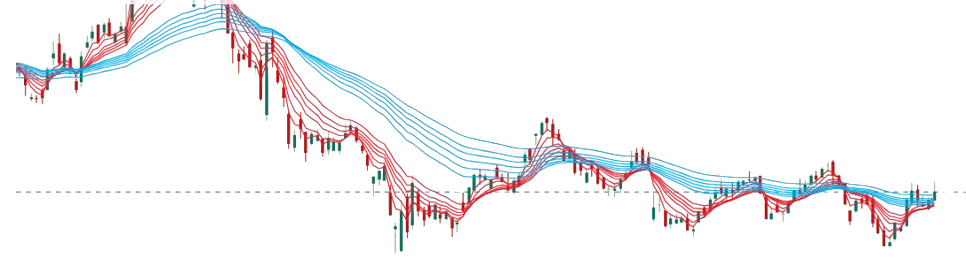

Technical Analysis

From a technical perspective, the stock appears to have completed an accumulation phase, forming a solid base with multiple support tests. This setup suggests potential for a fresh uptrend, making gradual accumulation attractive for patient, long-term investors.

Final Recommendation

GitLab represents a high-quality technology platform with clear competitive advantages, but its premium valuation requires validation. The company must demonstrate sustainable AI monetization, consistent free cash flow generation, and a strong competitive moat before such multiples can be fully justified.

The upcoming quarters will be critical in determining whether GitLab can deliver execution excellence and sustain growth. Until then, patience remains the prudent approach for risk-conscious investors.

From a technical perspective, the stock appears to have completed its accumulation phase, forming a solid base with multiple support tests and ongoing crossover attempts. This setup indicates potential for a fresh uptrend. Accordingly, gradual accumulation in batches may offer a favorable risk–reward profile for medium- to long-term investors.

Remember, this analysis is for educational purposes only. Always conduct your own research and consult with financial professionals before making investment decisions.

We want to hear from you!

What's your take on GitLab's current valuation and competitive position? Do you think the recent stock price decline presents a buying opportunity, or are the competitive pressures and valuation concerns valid reasons to stay away?