Executive Summary

Lennar presents a classic cyclical value dilemma. Despite attractive 10x P/E and strong balance sheet, declining earnings, margin pressure, and technical weakness suggest caution. The housing shortage provides long-term support, but near-term headwinds dominate.

Key Financials

FY 2024: Revenue $35.4B, Net earnings $3.9B, strong liquidity

Q2 2025: Net earnings $477M (missed consensus), Rev $8.38B (down 7% YoY)

Balance Sheet: Low 19.8% debt-to-capital, $2.1B cash

Concerns: Earnings trajectory declining, margins compressing from increased incentives

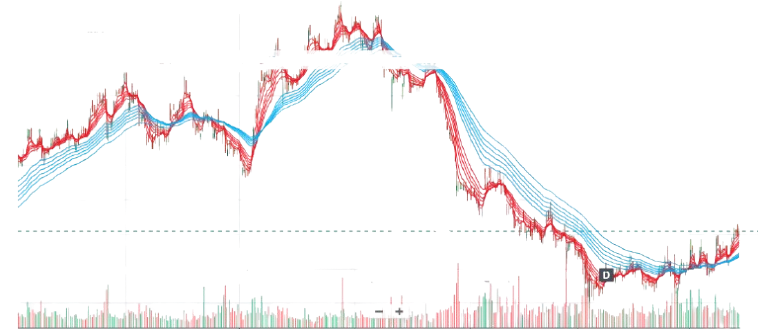

Technical Analysis

Current Level: $121

Moving Averages: Below 50-day (~$112) and 200-day (~$130)

Key Levels: Support $105-115, Resistance $130-135

Trading Targets:

Short-term: $130 target, $105 stop

Medium-term: $145 target, $95 stop

Long-term: $160-180 target, $80-85 stop

Investment Thesis

Bull Case: Housing shortage, strong balance sheet, cyclical recovery potential, analyst "Buy" consensus

Bear Case: Declining earnings, technical breakdown, high interest rates, margin compression

Market Dynamics: 7% mortgage rates hurt affordability, but 3-4M unit housing deficit supports long-term demand

Final Verdict

Lennar embodies cyclical value opportunity with significant execution risk. Strong fundamentals clash with current headwinds. Limited margin of safety at $121.

From the daily chart, it appears that after a meaningful decline, the consolidation phase has been completed, and the stock is now poised for a potential uptrend. Accumulation can be considered below $115, with a long-term holding horizon of at least 12–18 months. Position sizing should be limited to a maximum allocation of 3–5%.

Disclaimer

This research is intended solely for educational purposes and should not be interpreted as investment advice. Readers are encouraged to conduct their own due diligence and/or consult a licensed financial advisor before making any investment decisions. All information and data presented are sourced from publicly available company filings, analyst reports, and third-party sources believed to be reliable. While this report has been prepared independently, the views expressed are personal and may contain errors or subjective bias. The author holds no financial or personal interest in the company discussed and does not own any position at the time of writing.

Let Us Talk

What's your take on Lennar's current predicament? Are we witnessing a classic value opportunity or a value trap in the making?