Rocket Lab Corporation (RKLB) stands at a critical juncture, trading at $48.13 with a $24 billion market capitalization after delivering exceptional 676% annual returns. While the company has established itself as a legitimate space industry player, its current valuation reflects a pricing that assumes flawless execution of ambitious timelines. The success of the upcoming Neutron rocket program, scheduled for mid-2025 but facing potential delays, will largely determine current valuations justifications.

Financial Performance & Metrics

Q2 2025 Highlights

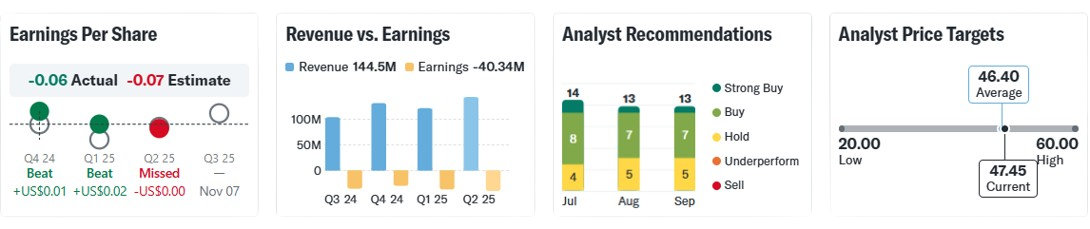

Revenue: $144.5M (record quarterly performance, +36% YoY growth)

Net Loss: $60.6M with widening losses (EPS -$0.10)

Cash Position: $517M providing operational runway

Contract Backlog: ~$1.0B ensuring revenue visibility

FY2025 Revenue Estimate: $588M representing 35% annual growth

The financial profile reveals a company in rapid growth phase while burning cash and expanding losses—a typical pattern for emerging space companies but one that demands careful timeline execution to maintain investor confidence.

Business Segment Analysis

Launch Services Division

Rocket Lab's Electron rocket has achieved significant market penetration as America's second-most launched orbital vehicle, completing over 70 successful missions. This operational track record demonstrates genuine technical capabilities and execution competency. However, the division faces mounting competitive pressure from SpaceX's aggressive rideshare pricing strategy.

Space Systems Division

The spacecraft manufacturing and components segment shows strong momentum, supported by government contracts including a notable $23.9M CHIPS Act award.

Neutron Program: The Make-or-Break Initiative

The Neutron rocket represents Rocket Lab's ambitious leap into medium-lift launch capabilities, targeting 13,000 kg payload capacity to low Earth orbit with expected revenue of $50-55 million per launch. Industry analysis suggests the mid-2025 launch timeline may be optimistic, with potential delays pushing initial milestones to mid-2026.

Investment Strengths

Proven Operational Excellence: Rocket Lab has demonstrated consistent execution with the Electron program, establishing credibility in a technically demanding industry where many competitors have failed.

Vertical Integration Strategy: The company's end-to-end space solutions approach provides competitive advantages through cost control, quality assurance, and customer integration capabilities.

Government Relationships: Strong positioning with defense and civilian space agencies creates stable revenue streams and strategic partnerships that competitors struggle to replicate.

Market Position: Clear differentiation from SpaceX in the small-to-medium lift market, avoiding direct head-to-head competition in heavy lift categories.

Critical Risk Factors

Timeline Execution Risk: The Neutron program's ambitious schedule leaves minimal buffer for typical aerospace development challenges.

Financial Sustainability Concerns: Continuous losses and negative cash flow create pressure for flawless execution.

Competitive Intensity: SpaceX's market dominance and aggressive pricing continue to pressure industry margins. New entrants and established aerospace companies add competitive complexity.

Valuation Vulnerability: Current trading multiples assume sustained high growth rates and successful technology transitions. Any execution missteps could result in significant share price volatility.

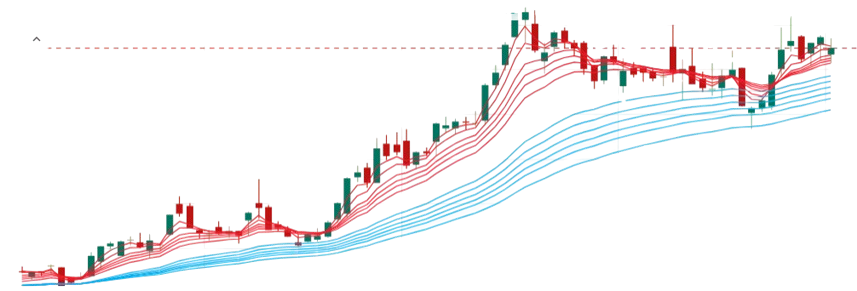

Technical Analysis & Price Outlook

Current Trading Data:

Price: $48.13

Market Cap: $24 billion

52-Week High: $53.44

Technical Levels:

Support Zones: $45 (50-day MA), $42, $38

Resistance Targets: $53.44, $60

Chart Pattern: Golden cross formation with 50-day MA above 200-day MA

Price Projections:

6-Month Target: $52-58 (assuming positive Neutron developments)

12-Month Optimistic: $85+ (successful Neutron deployment scenario)

The technical picture shows bullish momentum, but fundamental analysis suggests current levels may exceed intrinsic value based on present cash flows and execution uncertainties.

Key Catalysts & Timeline

Positive Catalysts:

Neutron test flights and development milestones

Major commercial or government contract announcements

Clear pathway to profitability demonstration

Risk Events:

Neutron timeline delays or technical setbacks

Increased capital requirements or dilutive financing

Intensifying competitive pressure from established players

Investment Recommendation

Rocket Lab represents legitimate space industry capabilities with proven operational competency and strategic market positioning. The company's track record with Electron launches demonstrates technical proficiency, while the Space Systems division provides diversification and government relationship advantages.

Strategic Recommendation: Exercise patience and wait for improved risk-adjusted entry points or concrete execution proof points before initiating significant positions. Current pricing assumes perfection in timeline execution—a rare occurrence in complex aerospace development programs.

Position Sizing Guidance: For investors committed to the sector exposure, consider modest position sizes that can withstand potential drawdowns.

Conclusion

Rocket Lab Corporation embodies both the tremendous opportunity and inherent risks of the commercial space industry. The company possesses genuine technological capabilities, operational competency, and strategic positioning that justify premium valuations under successful execution scenarios.

The prudent approach involves monitoring development milestones closely while maintaining realistic expectations about aerospace program timelines. Rocket Lab's long-term prospects remain compelling, but near-term valuation risk suggests patience may be rewarded with superior entry opportunities.

This research report is prepared for educational and informational purposes only. Investment decisions should be made after conducting independent research and consulting qualified financial advisors. Past performance does not guarantee future results.